National brand tours are one of the most powerful tools in experiential marketing—and one of the most complex to execute. Done right, they put your brand in front of millions of consumers across multiple markets. Done wrong, they become expensive lessons in logistics failures.

After executing dozens of national tours for brands like Coca-Cola, Gildan, and Dogsters, we've learned what separates successful tours from disasters. This guide covers the fundamentals every brand should understand before hitting the road.

Before You Start: Is a Tour Right for Your Brand?

Not every brand needs a national tour. Before you start planning, honestly assess whether a tour is the right vehicle for your objectives.

A tour makes sense when:

- You're launching a product that benefits from hands-on experience

- You need to build awareness in multiple markets simultaneously

- Your target audience gathers at specific events or locations

- You have enough budget to do it right (more on this below)

- You can measure success market by market

A tour probably isn't right when:

- You could reach the same audience more efficiently through digital channels

- Your budget only allows for a handful of markets

- Your product doesn't benefit from physical demonstration

- You don't have infrastructure to support leads from multiple markets

The Three Types of National Tours

Not all tours are created equal. Understanding which type fits your objectives will shape every subsequent decision.

1. Event-Based Tours

These tours follow an existing event circuit—music festivals, sports seasons, industry trade shows. You're piggybacking on events that already aggregate your target audience.

Advantages: Built-in audience, predictable traffic, established infrastructure.

Challenges: Competition for attention, venue restrictions, inflexible scheduling.

We executed this type for Gildan's Blake Shelton partnership, following the country music tour circuit. The audience was guaranteed—we just had to deliver an experience worth remembering.

2. Retail Tours

These tours activate at retail locations—grocery stores, big box retailers, specialty shops. The goal is usually driving trial or purchase at the point of sale.

Advantages: Direct path to purchase, retail partner support, measurable sales lift.

Challenges: Retail restrictions, smaller footprints, variable store support.

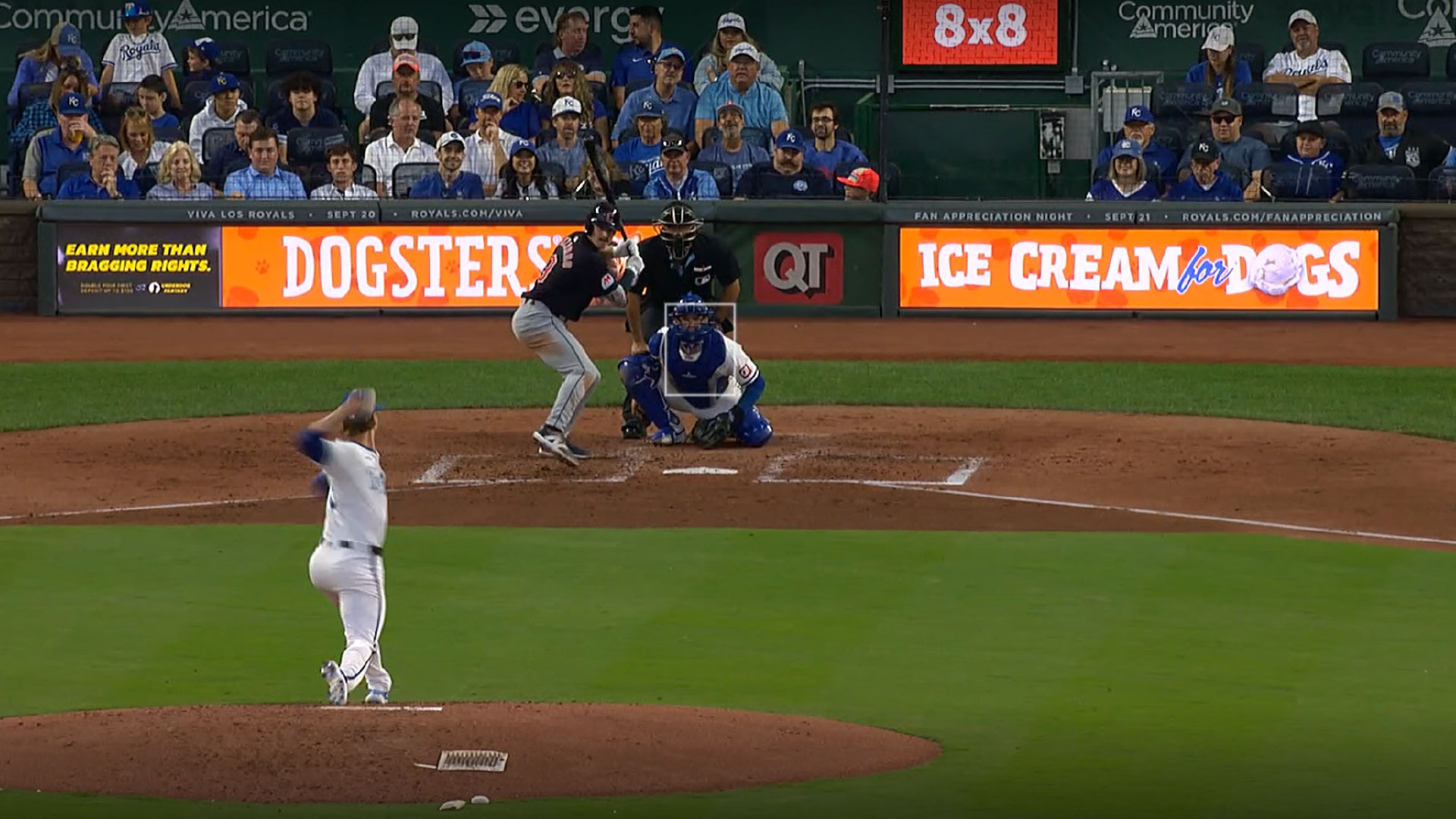

Dogsters' sampling tour fell into this category—getting product into hands right where people could buy it.

3. Custom Stop Tours

These tours create their own destinations—pop-up experiences, mobile showrooms, or unique venues selected for strategic reasons.

Advantages: Complete control over experience, unique brand moments, flexibility.

Challenges: Higher costs, audience generation responsibility, complex permitting.

Coca-Cola's Orange Vanilla launch tour combined elements of all three—custom experiences at strategic locations, retail activations, and event appearances.

Market Selection: Quality Over Quantity

The biggest mistake we see brands make? Trying to hit too many markets with too little budget. Ten markets done excellently will outperform thirty markets done adequately.

Here's how to think about market selection:

Start With Your Objectives

Are you trying to build awareness in underpenetrated markets? Reinforce presence in strongholds? Launch in new geographies? Each objective suggests a different market mix.

Consider Index Markets

Index markets are places where your target consumer is overrepresented relative to the general population. A brand targeting health-conscious millennials would index differently than one targeting college football fans.

Factor in Logistics

Routing matters. A tour that zigzags across the country wastes money on transportation and exhausts staff. Build logical routing that minimizes travel while maximizing market value.

Account for Local Dynamics

Every market has quirks—permitting processes, union requirements, weather patterns, competitive activity. Local knowledge prevents expensive surprises.

Budgeting Reality Check

Here's where most tour plans fall apart. Brands consistently underestimate what national tours actually cost.

Budget categories to account for:

- Asset development: Design, fabrication, and testing of your tour footprint

- Transportation: Vehicles, fuel, drivers, and logistics

- Staffing: Brand ambassadors, managers, and specialists at every stop

- Venues/permitting: Fees, insurance, and compliance costs

- Product/sampling: Whatever you're giving away, multiplied by every stop

- Travel: Hotels, per diems, and flights for oversight team

- Contingency: Because something will go wrong (budget 15-20%)

A rule of thumb: if your total tour budget is under $200,000, you probably can't execute a true national tour. You can do a regional tour, or a targeted set of activations—both of which can be highly effective—but "national" requires national-level investment.

Staffing: The Make-or-Break Factor

Your tour is only as good as the people executing it. The physical assets, the creative concept, the market selection—all of that is table stakes. What actually determines success is who's on the ground.

Don't Skimp on Tour Management

Every tour needs someone who owns the whole thing—not just individual stops, but the entire operation. This person solves problems in real-time, maintains quality control across markets, and serves as the single point of accountability.

Hire Brand Ambassadors, Not Bodies

The difference between a brand ambassador who connects with consumers and one who's just standing there is enormous. Invest in recruiting, training, and retaining great people.

Plan for Turnover

Long tours have turnover. Someone will get sick. Someone will quit. Someone won't work out. Build redundancy into your staffing model.

Local vs. Traveling Staff

Traveling staff provides consistency. Local staff knows the market. Most successful tours combine both—a core traveling team supplemented by local hires who understand regional nuances.

Measurement That Actually Matters

Tours generate a lot of data. The question is whether you're measuring what matters.

Vanity metrics (easy to measure, limited value):

- Total impressions

- Samples distributed

- Social media mentions

Meaningful metrics (harder to measure, actual value):

- Sales lift in tour markets vs. control markets

- New customer acquisition cost

- Qualified lead generation

- Brand perception shift (pre/post survey)

- Retailer relationship impact

The brands that get the most value from tours establish measurement frameworks before the tour begins, not after. They know exactly what success looks like and how they'll prove it.

Common Tour Failures (And How to Avoid Them)

Failure: Running out of product. Nothing kills momentum like telling consumers you don't have what they came for. Solution: Over-inventory every stop and build restocking logistics into your plan.

Failure: Equipment breakdown. Your custom-built experience is useless if it doesn't work. Solution: Test everything exhaustively before launch. Build in maintenance windows. Have backup equipment for critical elements.

Failure: Poor weather response. Outdoor tours are weather-dependent. Solution: Have a rain plan for every stop. Know your weather cancellation policies with venues. Build weather contingency into the schedule.

Failure: Inconsistent execution. Stop 1 looks amazing. Stop 15 looks tired. Solution: Clear standards, regular oversight, and consequences for quality lapses.

Failure: Local compliance issues. Permits, health codes, noise ordinances—every city is different. Solution: Research requirements for every market well in advance. Budget for compliance costs.

The Bottom Line

National brand tours are complex, expensive, and logistically demanding. They're also one of the most effective ways to build brand love, drive trial, and create memorable consumer experiences at scale.

The difference between tours that deliver results and tours that waste budget comes down to planning, execution, and measurement. Brands that invest in getting these fundamentals right see returns that justify the investment. Brands that cut corners see expensive disappointments.

If you're considering a national tour, start with honest questions: Do we have the budget to do this right? Do we have clear objectives? Do we have partners who've done this before? If you can answer yes to all three, a tour might be exactly what your brand needs.

Planning a National Tour?

We've executed tours for Coca-Cola, Gildan, Dogsters, and dozens of other brands. Let's talk about what a tour could do for yours.

Start the Conversation